A collection agency must utilize advanced technology and tools for debt collection, including automated communication Texting/Email as permitted by law, secure data management, 3rd Party Collections Agency and integration capabilities with AthenaHealth and a few other EHR’s through API’s.

Technological Capabilities

- Manage all your accounts online 24/7 using our easy to use client portal ( Submit, Update and Stop accounts online, provide backup documentation, view invoices and add/remove additional users online.)

- Two factor authentication is mandatory for login.

- Manage multiple locations using a single login. Switch between individual location using a simple dropdown box. Ability to set up clients as Master-Sub.

- Ability to upload accounts in a batch using Microsoft-Excel or through Sharefile.

- Online Reporting capabilities and view collection status of each account.

- Capability to set up and manage payment plans for debtors.

- Intuitive dashboard view for real-time monitoring of collection performance, outstanding amounts, and other key metrics.

- SSL (Secure Sockets Layer) is used to encrypt data when it is transmitted over the internet.

- Tools to manage and resolve disputes with debtors efficiently.

- Access to Client Portal FAQs, and simple PDF tutorials.

- Fortigate Cloud Firewall, VMWare Domain Controller and VPN mandatory for staff handling sensitive data.

- For fixed fee services, payments are accepted secure using Paypal/payscout in a PCI compliant manner.

- For contingency fee services, your portion of the money can be directly deposited in to your bank electronically using ACH. However if you prefer physical check, we can do that too.

- For fixed fee services, accounts purchased master client number can be used by various Locations/Subs under it.

Customer Service

- An account representative is assigned to each client for personalized service who acts as a single point of contact to address any concerns promptly. Email, call or text.

- Access to the central client customer support number if required.

- Comprehensive onboarding sessions to familiarize clients with the portal, processes, and services. Interactive Zoom/MS teams training available as many times as you want.

Value Added Services

- Free Bankruptcy screening on all accounts submitted.

- Free Credit Bureau reporting in contingency collections.

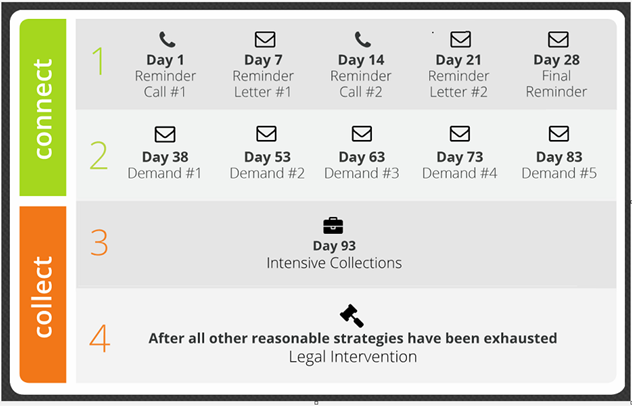

- Free Change of Address check ( USPS check in Step 1 & 2 and Skip tracing in Step 3 & 4).

- Free Litigious patient check. ( protect you from debtors who have a history of suing)

- We can perform debt collections in both English and Spanish.

- Share industry best practices and insights to help clients enhance their collection strategies.

- Garnish wage, Identify and locate assets of debtors for potential recovery during legal step.