Here’s a breakdown of how to create an effective follow-up system for your dental practice to address unpaid bills and denied claims:

Unpaid Dental Bills

-

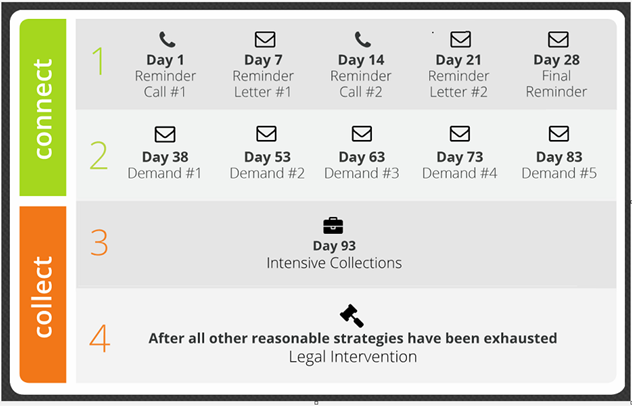

Graduated Timeline:

- 30 Days Past Due: Send an initial friendly reminder notice via email or mail.

- 60 Days Past Due: Issue a second notice with a clearer request for payment, potentially include phone outreach.

- 90 Days Past Due: Consider a final notice with a strong emphasis on the need for payment. Assess if a payment plan is appropriate.

- 120+ Days Past Due: Evaluate if it’s worth engaging a collections agency.

-

Patient Communication:

- Be Professional and Respectful: Maintain a professional yet firm tone. Avoid accusatory language.

- Offer Payment Options: Discuss convenient payment plans or alternative financing options if affordability is an issue.

- Document Everything: Keep clear records of all communication attempts, dates, and any agreements reached.

-

Automate Where Possible:

- Use billing software: Utilize features for scheduling automated overdue reminders and statements.

- Online payment portals: Offer easy online payment options to increase the likelihood of timely payment.

Denied Dental Insurance Claims:

-

Immediate Investigation:

- Analyze Denial Codes: Carefully review the denial reason code provided by the insurance company. Common issues include missing information, coding errors, or lack of pre-authorization.

- Correct and Resubmit: Address the reason for denial, correcting any errors, and resubmit the claim promptly.

- Track Resubmissions: Create a tracking system specifically for resubmitted claims to monitor progress and ensure deadlines are met.

-

Insurance Company Follow Up:

- Dedicated Staff Member: Consider having a designated staff member responsible for tracking and following up on denied claims.

- Establish Contact: Identify the correct contact person at the insurance company for handling claim inquiries.

- Clear Documentation: Maintain detailed records of all communications, dates, and outcomes of any appeals.

-

Appeals Process:

- Understand Appeal Deadlines: Be aware of the time limits for filing appeals with different insurance companies.

- Gather Supporting Documentation: Collect any required additional documentation that may support your claim (clinical notes, X-rays, etc.).

- Submit a Strong Appeal: Craft a clear and detailed written appeal refuting the denial, citing relevant insurance policy terms and supporting documentation.

Additional Considerations

- Prevention is Key: Invest time in upfront insurance verification and pre-authorizations for complex procedures to minimize the chances of denials.

- Staff Training: Ensure your billing staff is well-trained in coding procedures, insurance processes, and effective communication techniques.

- Consider Outsourcing: If managing follow-ups becomes too burdensome, partnering with a specialized dental billing company can alleviate the workload.