Florida dentistry runs on speed and volume—Miami to Orlando to Tampa—while patient responsibility keeps climbing with every plan reset.

Along the I-4 corridor and the I-95 spine, practices are delivering premium care… then waiting too long for balances to close.

When accounts linger, it’s not just cash flow. It’s staff fatigue, schedule disruption, and a front desk stuck in conflict.

Protecting your practice’s reputation, CA-USA holds licenses in all 50 states, ensuring a safe approach for every patient interaction. We provide free litigation and bankruptcy scrubs with zero onboarding or annual fees. Our SOC 2 Type II and HIPAA-compliant systems ensure total data security, backed by a 4.85/5 rating from over 2,000 professional reviews. Delivering high recovery rates!

Need a Dental Collection Agency? Contact us

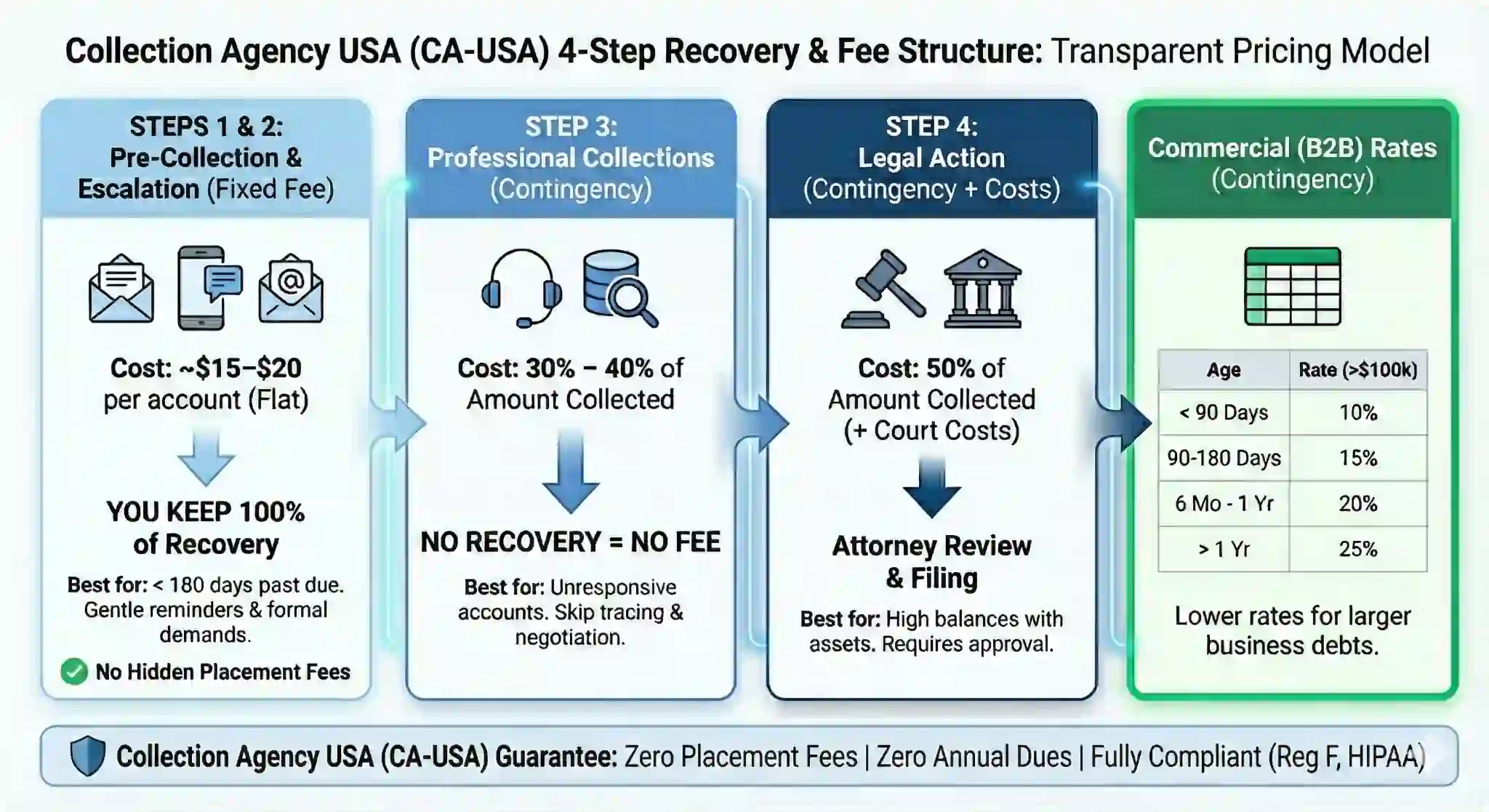

Revenue Recovery Pricing (Built for Dental AR)

CA-USA gives Florida dental offices two direct options:

- Fixed-Fee: $15 per account (your practice keeps 100% of what’s recovered)

- Contingency: 40% (no recovery, no fee)

Use the fixed-fee lane when the patient is reachable and the balance is recent. Use contingency for older, inconsistent, or higher-friction accounts.

The CPA Edge: Why $15 Often Pays for Itself

That $15 fixed-fee can often be treated as a tax-deductible business expense after CPA guidance.

In practice terms: many offices reduce the true net cost while still bringing money back into the clinic now—without adding stress to the team.

The Patient-Responsibility Gap (Florida is Feeling It Hard)

Dentistry is increasingly patient-pay. High deductibles. Annual maximums that run out early. Partial coverage that creates confusion at checkout.

Then life happens. Storm season. A job change. A new insurance card.

Patients don’t always refuse. They drift. And drift turns into delay, then avoidance.

That’s why we treat recovery like a clinical process: confirm the facts, lower the temperature, and guide the account to resolution.

Peace of Office: Let Your Staff Stay in Patient Care

Your front desk shouldn’t spend their best hours negotiating payment behavior.

Outsourcing account reconciliation reduces burnout and protects your culture. It also improves the patient experience because your team stops being forced into hard conversations at the worst possible moment—right after treatment, right before the next patient, right in the lobby.

Respectful Friction: Protect the 5-Star Practice

Florida is a review-driven market. One harsh billing conversation can turn into a public complaint on Google or Healthgrades by dinner.

Our model uses respectful friction: firm boundaries, calm language, and structured options. We work with the patient, not against them—while staying aligned with HIPAA privacy expectations and keeping your reputation insulated from emotional blowback.

And because Florida is diverse, we also use Spanish-speaking specialists to remove language barriers, reduce miscommunication, and close balances faster.

Recent Recovery Results (Clinical Context)

Result 1 — Senior Living / Complex Care Specialist (Sarasota)

-

The Case: A specialist serving older adults in Sarasota had accounts building after treatment completion—multiple responsible parties, missed statements, and confusing insurance timing.

-

The Respectful Intervention: We began with verification: updated addresses, clarified contact pathways, then delivered a respectful reconciliation message offering two clear outcomes—structured plan or accelerated settlement. We used secure digital outreach to reduce phone friction and document patient consent-based communication steps.

-

The Financial Result: The practice recovered meaningful balances without upsetting families, without staff escalation, and without destabilizing patient trust.

Result 2 — Orthodontic Practice (Orlando / Lake Nona Area)

-

The Case: An orthodontic office near Orlando’s Lake Nona medical hub faced recurring payment breakdowns tied to mid-treatment plan changes, autopay failures, and guardians assuming “insurance has it handled.”

-

The Respectful Intervention: We stabilized the account narrative fast—confirming responsibility, updating contact points, and using bilingual outreach when needed. When disputes surfaced, we kept it clinical: explain the timeline, show the balance logic, and offer a resolution path that preserves goodwill.

-

The Financial Result: Collections improved without dismissing patients mid-treatment. The office regained monthly cash consistency and kept schedules full.

The Security Suite: Patient Scrub Before Outreach Intensifies

Before pressure rises, we protect your practice with a layered screening process:

-

Litigation check to identify high-risk profiles early

-

Bankruptcy check to avoid improper pursuit

-

USPS address verification to reduce misdirected outreach

-

Skip tracing for outdated contact information

Quality Control + Modern Channels

Every practice worries about “rogue collectors.” You should.

That’s why all calls are recorded and reviewed for quality assurance—protecting your brand and reducing “review-bombing” risk.

We also use secure, HIPAA-conscious email/text when appropriate to speed up responses, especially for Florida patients who screen unknown calls.

Areas of Expertise

Healthcare & dental (Hospitals/Clinics)

Dental (General/Orthodontics)

Regulatory Landscape: Florida + Federal Guardrails

Florida offices require compliance discipline and communication discipline.

We align our process with FDCPA standards, Florida’s FCCPA (Fla. Stat. §559.72) restrictions on prohibited practices, and HIPAA privacy safeguards for patient information.

We also respect the patient sensitivity created by the No Surprises Act, which has elevated expectations around billing clarity, estimates, and dispute handling. Your messaging must be accurate, defensible, and calm—especially when patients are already frustrated.

FAQs Florida Dental Leaders Ask

How do you handle patient disputes without losing loyalty?

We de-escalate first. We clarify the clinical and billing facts, document the options, and guide the patient toward a resolution that feels fair—not hostile.

Will outsourcing increase complaints or negative reviews?

Not when handled correctly. Our respectful friction approach, recorded call reviews, and structured communication reduce reputation risk.

Do Spanish-speaking specialists actually help recovery?

Yes. When language barriers drop, confusion drops. And when confusion drops, patients resolve faster.

Need a Florida Collection Agency? Contact us