|

| HOME | COLLECTION AGENCY | CONTACT US |

Nationwide Commercial Collection Services: Protect Your B2B RevenueBusiness borders shouldn't stop your cash flow.

Whether your debtor is a tech startup in San Francisco, a manufacturer in Texas, or a retailer in New York, the impact of an unpaid invoice is the same: it drains your working capital. You delivered the goods. You performed the service. Now, you are being treated like a bank, financing your client's business interest-free. We are a specialized Commercial Collection Agency operating in all 50 states. We don't just "dial for dollars"—we use forensic investigation, asset tracking, and legal leverage to recover B2B debt that others write off.

Our Priorities

Why 2,500+ CFOs & Owners Trust CA-USAIn an industry known for aggressive tactics and call centers, we built a reputation for results, respect, and direct access. 1. You Get a Partner, Not a "Ticket Number"Most agencies hide behind a general support email. We believe you deserve direct access to the person handling your money.

2. The "Fresh Debt" AdvantageTime is your enemy. Statistics show that a commercial invoice loses over 30% of its recoverable value after just 90 days.

3. Zero Risk Pricing

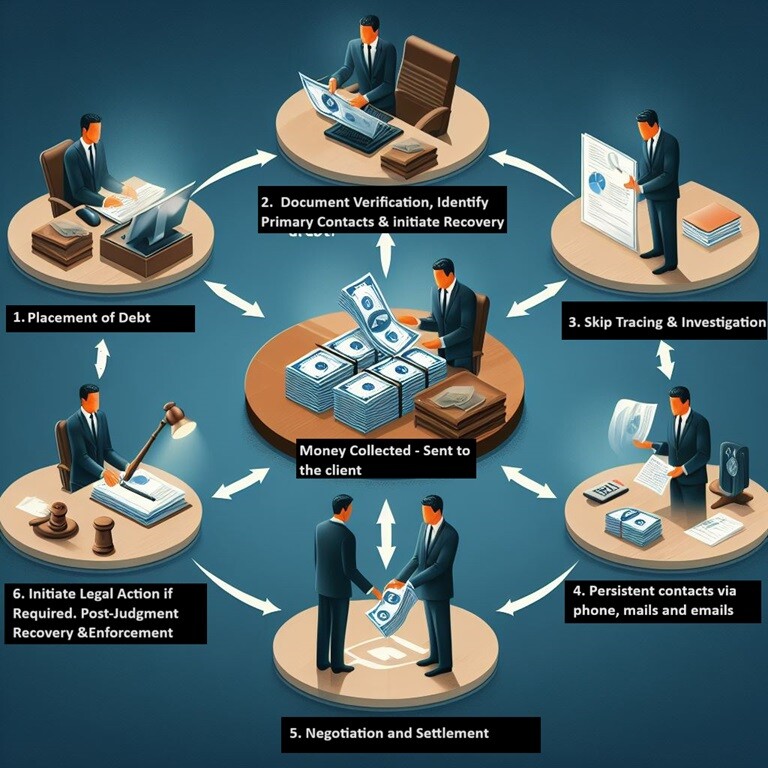

Our B2B Recovery Process: From Investigation to EnforcementWe use a forensic 10-step process to ensure no stone is unturned. 1. Placement & Document Verification: We review your Purchase Orders, Master Service Agreements (MSAs), and invoices. In commercial disputes, the "Battle of the Forms" wins cases. We ensure your paperwork supports the claim. 2. Deep Skip Tracing & Corporate Investigation: We don't just look for a phone number. We investigate the business's health:

3. The "Why" Analysis: We determine the real reason for non-payment. Is it a cash flow crunch? A quality dispute? Or intentional fraud? Our strategy shifts based on the answer. 4. Strategic Pursuit: We bypass the gatekeepers and contact decision-makers (CFOs, Controllers, Owners) via phone, email, and written demand. 5. Negotiation & Settlement: Our goal is 100% recovery, but we are pragmatic. If a settlement gets you paid faster than a lawsuit, we present you with the numbers so you can decide. 6. Legal Action (The Last Resort): If a solvent business refuses to pay, we escalate. With your permission, we forward the file to our specialized network of commercial litigation attorneys in the debtor's specific jurisdiction. 7. Post-Judgment Enforcement: Winning a lawsuit is easy; collecting is hard. Once a judgment is secured, we move to enforcement: Bank Levies, Liens on Property, and Asset Seizure.

Can We Attach the Business Owner's Personal Assets?This is the most common question in commercial collections. The answer is: It depends. Generally, a Corporation or LLC protects the owner's personal assets (cars, homes, personal savings) from business debt. However, there are two powerful exceptions we investigate:

Stop Funding Your Clients' BusinessYour capital belongs in your bank account, not theirs. Get the dedicated support you deserve. Contact us | 1-844-666-7890 | support@CollectionAgencyUsa.com |

|

COPYRIGHT: SACHING.COM | ALL INFORMATION ON THIS WEBSITE IS FOR GENERAL INFORMATION ONLY AND IS NOT A PROFESSIONAL OR EXPERTS ADVICE. WE DO NOT OWN ANY RESPONSIBILITY FOR CORRECTNESS OR AUTHENTICITY OF THE INFORMATION PRESENTED ON THIS WEBSITE, OR ANY LOSS OR INJURY RESULTING FROM IT Old Site. |